As climate resilience, rapid carbon reductions and a broader focus on sustainability take centre stage for governments around the world, tolling and road user charging will play a huge role in raising the trillions of dollars needed to support more sustainable infrastructure investment.

Members of the International Bridge, Tunnel and Turnpike Association (IBTTA) are already stepping up to both the challenge and the multiple opportunities in getting the world’s runaway greenhouse gas (GHG) emissions under control.

The association recently announced a new task force on sustainability and resilience and concessionaires in the European Union are engaging with the European Green Deal, which aims for deep decarbonisation by 2050.

“Achieving a climate-neutral continent will require the full mobilisation of industry stakeholders,” states Asecap, the European Association of Operators of Toll Road Infrastructures. “In this framework, the toll motorway sector has been reaffirming its commitment to prepare next-generation mobility” as part of the drive to reduce transport emissions by 90% by mid-century.

That means “fostering the deployment of green, safe and innovative transportation, including multimodal and autonomous options, as well as the deployment of alternative fuels infrastructure”.

‘Wandering into a minefield, blindfolded’

The new emphasis on carbon reductions and climate solutions is driven by a mix of urgency, opportunity and new momentum.

In late February, United Nations Secretary-General António Guterres declared a “red alert for the planet” after an assessment of countries’ latest action plans under the 2015 Paris Agreement pointed to just a 0.5% reduction in global GHG emissions by 2030—desperately short of the 45% target laid out by the Intergovernmental Panel on Climate Change in a landmark assessment two and a half years ago.

“The message is extremely clear,” said UN climate secretary Patricia Espinosa.

“We are collectively wandering into a minefield, blindfolded. The next step would mean disaster.”

At the same time, for a sense of the massive business and societal opportunity in the transition from carbon, look no farther than the September 2018 report of the Global Commission on the Economy and Climate. It pointed to US$26 trillion in economic benefits through 2030, if governments pursue the “bold action” required to address the climate crisis.

“We are at a unique ‘use it or lose it’ moment,” Commission co-chair Ngozi Okonjo-Iweala, a former Nigerian finance minister, said at the time. “Policymakers should take their feet off the brakes, send a clear signal that the new growth story is here, and that it comes with exciting economic and market opportunities. US$26 trillion and a more sustainable planet are on offer, if we act decisively now.”

Since then, with the cost of low-carbon solutions plummeting and public demand for climate action at an all-time high, governments have indeed begun shifting policies. After the EU adopted its European Green Deal last year, China pledged to peak its emissions before 2030 and achieve carbon neutrality by 2060, and several other major economies in Asia made their own commitments.

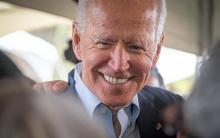

The US rejoined the Paris Agreement in February, and was expected to release a new, improved carbon reduction target ahead of a climate leadership summit that US President Joe Biden has announced for Earth Day, 22 April. State and local governments are urging the Biden administration to declare a 2030 carbon reduction target of 50%, which would bring it in line with America’s original commitment under the Paris agreement.

So the direction of travel is becoming clearer. And with governments and the financial sector aiming to mobilise trillions of dollars, euros and yuan for low-carbon investments, the sheer size of the enterprise creates a shining moment of opportunity for tolling as a proven funding and financing mechanism for surface transportation.

Time to ‘act and be steadfast’

IBTTA is standing up its new task force as climate change is already affecting tolling operations in many parts of the world. From an organisational standpoint, the timing for the new initiative couldn’t be better: it’s getting under way just as the association reviews its strategic plan that will carry the industry through the next several years of pandemic recovery and economic resurgence.

“With governments everywhere taking action on the climate crisis, tolling and user financing can be an important part of the solution, and it’s time for IBTTA to seize the momentum,” said Mark Compton, IBTTA president and CEO of the Pennsylvania Turnpike Commission, at a February CEO roundtable on sustainability and resilience.

“As transportation leaders, we have an obligation to act and be steadfast,” said Pedro Costa, CEO of the Northwest Parkway in Colorado, and the original catalyst for the roundtable. With annual increases in GHG emissions showing “no signs of letting up”, he noted that many tolled facilities are already seeing the impact of extreme weather events, including road closures due to wildfires, evacuations and closures ahead of hurricanes and floods, and development plans constrained by drought.

“The challenge is bigger than any person, organisation or industry,” Costa added, “and it can only be solved if we all come together.”

In a CEO survey that IBTTA distributed ahead of the roundtable, agencies listed flooding, rising demand for emergency preparedness and response, severe storms, and wildfires as the most common climate risks they’ve faced to date. More than half said they’d taken steps to address climate impacts, improve sustainability along their roadways or introduce renewable energy policies and practices. Three-quarters said they’d shifted their maintenance and roadway operations practices.

Investing in the ‘evolution of mobility’

For Asecap, action on climate change is a natural outgrowth of a two-decade focus on next-generation mobility solutions. Tolling concessionaires “have been very much involved in ITS and innovation to provide customers the best mobility service, delivering safe, comfortable and uncongested travel on the motorways we operate”.

The organisation cites real-time traffic information systems, travel time forecasting, real-time speed limit regulation, and electronic tolling as on-the-ground innovations that have “significantly contributed to reduced CO2 emissions” while minimising the environmental impact of highway transportation.

While Europe’s shift to green mobility is well under way, Asecap sees new investments growing in step with the size and population of European cities. Fast-charging stations for electric vehicles, carpool parking for shared mobility, multimodal connections between tolling and transit, waste recycling, increased use of photovoltaic solar to power toll operations, roadway digitalisation and support for cooperative ITS (C-ITS) are all high on the agenda.

“Commute times, congestion, air pollution and noise are increasing everywhere in Europe,” the association says. “To meet those challenges, toll road infrastructure operators will be investing to boost new mobility frameworks and contribute to decarbonisation of road transport to reach the target of carbon-free emission by 2050.”

It begins with political will

Asecap points to strong political will as an essential ingredient to “accelerate the process” on climate and decarbonisation. With the European Green Deal in place, and the new US administration positioning climate action as a centrepiece of its economic, environmental and social justice agendas, a moment of consensus may have arrived.

The next major policy milestone might not be far off. During last year’s election campaign in the US, then-candidate Biden promised to “create millions of good, union jobs rebuilding America’s crumbling infrastructure—from roads and bridges to green spaces and water systems to electricity grids and universal broadband—to lay a new foundation for sustainable growth, compete in the global economy, withstand the impacts of climate change, and improve public health, including access to clean air and clean water.”

The new administration’s first priority is pandemic relief. News reports in early March suggested a major infrastructure bill was coming soon, and Senator Thomas Carper (D-DE), chair of the powerful Senate Environment and Public Works Committee, has laid plans to map out a new surface transportation bill for adoption this year.

All of which means that governments, industries and citizens are in for a period of rapid change and huge potential. One of the few certainties is that investment dollars will be needed to deliver on the policy commitments—and that when it comes to surface transportation, tolling and user financing will be a key tool in the toolbox, same as they’ve ever been.