The case is growing for an alternative to fuel taxation for funding highway infrastructure. A more sustainable system of mileage-based charging can be established in a way that is acceptable to the travelling public, writes Jack Opiola. Fuel tax - the lifeblood relied on for 80 years to maintain and improve roads and transit systems - is now in considerable jeopardy in the United States. Increased vehicle fuel efficiency and a poor economy already hamper generation of fuel tax revenue; now a recent federal

"Though laudable for reduction of greenhouse gases and reliance upon foreign oil, this policy will have a devastating impact on highway funding"

The case is growing for an alternative to fuel taxation for funding highway infrastructure. A more sustainable system of mileage-based charging can be established in a way that is acceptable to the travelling public, writes Jack Opiola.

Fuel tax - the lifeblood relied on for 80 years to maintain and improve roads and transit systems - is now in considerable jeopardy in the United States. Increased vehicle fuel efficiency and a poor economy already hamper generation of fuel tax revenue; now a recent federal policy move has turned the fuel tax into an anachronism.Last month the federal government announced a sizeable increase in the corporate average fuel economy (CAFE) standards for new vehicles, bumping the required average of 35.5 miles per gallon in 2016 to 54.5 miles per gallon by 2025. Though laudable for reduction of greenhouse gases and reliance upon foreign oil, this policy will have a devastating impact on highway funding if US Congress does not take corresponding action to identify revenue not based on fuel consumption.

Current signals of intention from Congress are mixed - the House has proposed to limit spending to the level of fuel tax collected while the Senate wants to augment these funds with additional revenues to stimulate the economy and foster job growth. Highway infrastructure is too important and critical a utility to face an ongoing crisis as to how it should be funded.

Despite congressional differences, however, some cars on our streets already contain much of the technology to meet the new CAFE standards. Fuel efficiencies of many hybrid electric vehicles are approaching 50 miles per gallon and steadily raising the fleet averages. Now entering the marketplace are fully electric and plug-in style hybrids -

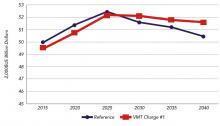

These vehicles, capable of nearing or exceeding the calculated equivalent of 100 miles per gallon, will generate little fuel tax. It is estimated the entire fleet will need about 40% of the fuel it currently consumes, reducing tax revenue by about two-thirds.

Merely increasing the fuel tax to cover lost revenue will not solve the problem.

Doing so would create an ever-widening inequity between owners of highly fuel efficient vehicles and those pay a far heavier burden by continuing to operate conventional cars. Even if raising the gas tax did not have significant equity issues, it is doubtful the gas tax could be raised to the level needed to preserve revenues. It will become clear to all levels of government in the US and around the world that fuel tax is simply not a viable mechanism for funding highway infrastructure.

Alternative funding sources must be found to maintain the health of highway systems and their positive affects on jobs and economies. Policymakers have considered replacements for the fuel tax, such as sales taxes, registration fee increases, personal or real property taxes, income tax, value-added tax, tolling high capacity highways, taxes on oil company profits and others.

But each shifts the burden of paying for the roads from one type of user to another or to non-users. In almost all of these cases, the proposed alternatives are less equitable than the current system.

The only fair way to apportion road costs is by usage. The fuel tax is based on use, but its consumption linked formula is woefully out of date and not correctable.

Some saw the decline of fuel tax coming more than a decade ago when the hybrid electric automobile first became available. That is when the states of Oregon and Minnesota, and the University of Iowa started work on a tax regime based on miles travelled rather than fuel consumed. Called the vehicle mileage tax or VMT, policy experts envisioned this new tax as the principal funding mechanism for the US road system. Its concept is simple: the more miles driven, the more paid.

Since two congressional commissions on transportation funding endorsed VMT as the most viable alternative to the fuel tax in 2008 and 2009, the US has done little to advance the discussions.

Hampering the policy dialogue are perceived privacy implications of using GPS receivers to meter mileage and concern over a new government bureaucracy.

Early piloting of mileage tax did use GPS receivers, albeit without retention of personal data or tracking of individual vehicle movements. As a result, many have come to regard VMT as synonymous with a government mandate for GPS metering devices. The mileage tax is not synonymous with GPS and can be implemented without a mandate for a government provided GPS unit. There are several different potential pathways for implementing VMT, of which only one is a GPS-based solution.

Key to a mileage tax system without a GPS mandate is offer of choice and a VMT system can offer motorists several choices for reporting mileage and paying the tax. Distance driven could be pre-paid by the user via the Internet or distance travelled could be reported directly from the vehicle's odometer system automatically via an embedded communication system, or in an assisted fashion via users' Bluetooth enabled devices.

In these non-GPS solutions, accuracy of odometer readings is key. Research on this subject has found odometers vary by degrees. The norm of variance appears to be about 5% of the actual distance travelled, or much higher in some cases.

For VMT to be introduced on odometer readings, standards and measures would have to be addressed to tighten up variances and prevent fraud or under reporting of vehicle miles.

By comparison, GPS has proven to be much more accurate, consistently within 0.5% of the actual distance travelled.

Drivers may choose to use their own GPS devices such as navigation units or smartphones to report mileage travelled. This user declaration, or self reporting, can use features of the GPS to provide distance travelled on or off road, in or out of state, or it could be combined with other road user charging concepts such as tolling and congestion charging.

Another alternative, allowing motorists to avoid technology altogether, would involve payment of a flat tax rate every calendar or fiscal year to cover the cost of miles travelled in a single VMT domain.

Should the driver roam into other jurisdictions or VMT areas, this method would need to address differences in flat fees set, or like in many European countries, impose a flat 'vignette' fee for travel in that jurisdiction.

The mileage tax could be developed with a light touch applied to revenue collection. With a system designed as open - not beholden to any particular technology - the market place would supply the necessary technology and data collection services, certified to ensure the system works consistently.

Through public private partnerships, the Government could contract the tax collection function to private companies, with competition driving down administrative costs. Government would provide oversight and certification of private sector providers to ensure fairness.

Since the underlying purpose of the mileage tax would be to generate sustainable revenues, the new collection system need not apply to every vehicle from the outset. Fuel tax works well for larger passenger and working vehicles and should remain in place for these vehicles.

VMT should apply to the new highly fuel efficient vehicles to ensure operators of these vehicles pay their fair share of roadway costs. Earlier this year, the Oregon Legislative Assembly considered legislation applying VMT to electric vehicles and plug-in hybrids.

To encourage public acceptance of these new automobile products, the proposed mileage tax had a delayed start of 2015 at a transitional rate of 0.85 cents per mile, rising to 1.56 cents per mile in 2018. Two legislative committees, with bipartisan support, accepted the viability of VMT for these new vehicles.

At the end of the legislative session, the bill stalled, not because of concerns over privacy or a new government bureaucracy, but because it was, after all, a new tax.

US policymakers have the opportunity to enact a mileage tax system that will resolve public concerns. Political steps made in Oregon this past year indicate that structuring VMT without a GPS mandate and giving motorists a choice of means for compliance has the potential to yield a system that is acceptable. In the process, transparency can be restored to the tax collection system whereby every vehicle owner will be able to see exactly how much they contribute to federal or state funds for highway infrastructure.

Once politicians take measure of the possibility of an acceptable mileage tax design, they should be willing to acknowledge that operators of new fuel efficient vehicles must pay fairly for their use of the road system. The highway system's health, the nation's economy and the principle of fairness to all depend on it.